The Covid-19 Challenge: How to build a better FS sector

By Teamspirit on Thursday 7 May 2020

Our viewpoint, the opportunities and the potential transformation.

Financial services is familiar with crisis

Global health crisis Covid-19 has already changed life as we know it. The virus and its tragic human impact have resulted in unprecedented government intervention, social isolation measures, record unemployment - and the biggest fiscal stimulus ever launched.

On an economic level, central banks have responded by cutting interest rates, lending freely and encouraging financial institutions to extend credit to adversely affected firms and consumers, to prevent a prolonged recession. In capital markets, Covid-19 has caused the fastest bear market in history. On top of this, we’re seeing huge shifts in the way that we work, educate and consume, with technology and automation set to transform industries in wholly new ways.

...but this time we’ll emerge differently

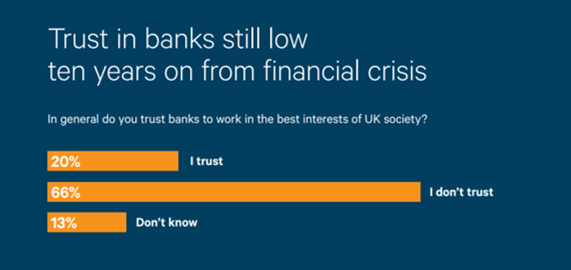

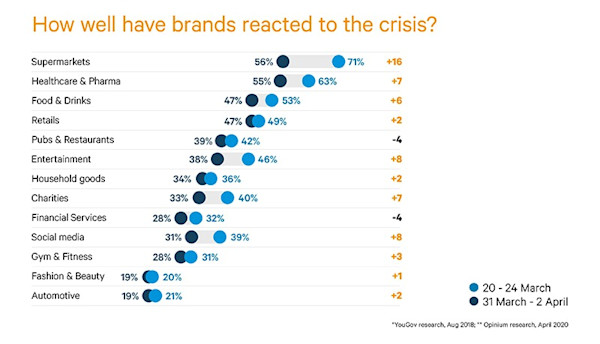

This is very a different landscape from the financial crisis of 2008, when financial institutions were seen as being responsible, then rescued by the Government and ultimately the taxpayer. The distrust of banks has continued: in 2018, a YouGov survey revealed that a staggering two out of three people in the UK don’t trust the banks to work in the best interests of society. A recent survey also suggests that financial brands could improve their reaction to the current crisis.

Banks and financial institutions are in a stronger position

Governments already expect banks to fuel our recovery from the crisis, promising support for their readiness to lend. Moreover, with stronger financial regulation (e.g. The FCA’s SMR), disruptive technologies and competition affecting the sector, the focus of FS brands firms has turned towards the needs of the customer. During the Covid-19 crisis, we’ve seen the FCA imposing debt payment holidays; and the Bank of England has warned lenders and insurers to withhold dividends in order to protect their balance sheets and prioritise their customers.

The benefits of adopting a longer-term view are also in evidence in capital markets where we’ve witnessed the resilience of ESG investing during the crash, adding to speculation that companies marrying profits with social purpose will continue in popularity once the crisis passes.

Global lockdowns have also highlighted the environmental benefits of a less frantic pace of life, with UK air pollution down by over a third. Arguably, the legacy of Covid-19 will be foregrounding the power of (and need for) collective action in response to the world’s next major health crisis – climate change.

Covid-19 will act as a catalyst for existing trends such as technological adoption, automation and wellness – areas which the financial sector is already navigating through mobile adoption, AI and efforts to promote education, professional advice and financial wellbeing.

Covid-19: The catalyst for existing trends...

Covid-19 will accelerate existing macro trends which will transform industries, including:

Technology

The crisis has forced us into the wholesale adoption of technologies, with work, education and retail going virtual. Trends likely to accelerate include supercomputing (big data) and interconnected technology (Smart Cities, 5G, IoT).

Automation

The downturn will increase levels of automation – for example software, AI and robotics – with businesses under pressure to restructure, so there may be a second human cost in terms of livelihoods. 41% of businesses are set to accelerate automation post-crisis.

Wellbeing

Healthcare and wellbeing will be in sharp focus – with a holistic view becoming more widely accepted, as well as protecting ageing populations, safeguarding universal systems, and rapid adoption of digital health and telemedicine.

...coupled with megatrends to shape the ‘New Normal’

■ Isolationism (post peak globalisation): Focus on resolving trade disputes and strengthening local ties.

■ Quantitative limitations: Central banks have pushed the limits of monetary policy with QE, with interest rates already low or negative.

■ Climate change: Attention turns to policy, solutions and the e-technologies to solve it.

■ Conscious capitalism: A move to stakeholder capitalism and more weight to ESG criteria and employee satisfaction, alongside profit.

■ Automation: Rapid rise of robots, automation, 5G and Smart Cities.

■ Older societies: Ageing populations; growing middle class in developing countries.

So, who will emerge the winners? The progressive and pragmatic

Not all companies follow the same strategies during a recession, and not all will emerge triumphant. However, history shows us that winners achieve the difficult but optimal balance of defence and offence, commonly displaying the following traits:

■ Recognise cost-cutting is necessary to survive, but that investment is necessary for growth.

■ Tend to prioritise operational efficiency over employee cuts.

■ Offensive strategies are comprehensive e.g. creating new business opportunities by making significantly greater investments than rivals do in R&D and marketing and investing in assets such as plants and machinery.

The opportunity for Finance? Be a driver of positive change

Alongside structurally fueling the recovery, financial services has a crucial role to play in ensuring that we can emerge from this crisis resilient and equipped with a longer-term mindset.

The opportunity to ensure customers – both consumers and SMEs – are financially resilient for future challenges, with a focus on education, financial wellbeing and their ability to plan for the long term.

The opportunity for asset managers to adapt their strategies towards companies with strong, long-term fundamentals, and to create portfolios that can weather crises such as this one. By thinking for the long term themselves, and encouraging customers to do the same, companies will transform not only Finance but our society for the better.

“This crisis did not originate in banking, but they can be part of the solution, and it might engulf them instead if they turn away. They must not gouge customers, and need to suspend dividends and high-end bonuses.”

Paul Tucker, Chair, Systemic Risk Council

Communication is always the answer

Building better relationships with colleagues, clients, customers and community.

In a crisis, communication is not only crucial, but can be transformative. At Teamspirit, we believe in transforming the world of finance for the better – something we’ve been doing for the past 25 years - in and out of a number of market crises.

Every crisis brings new challenges, but how financial firms communicate during these uncertain times is crucial for cementing and transforming their most important relationships – from employees, to customers, suppliers, creditors, investors and wider communities.

During crises, people still need information, guidance, inspiration and entertainment – and we’re currently helping our clients strategise and shape the stories they will deliver going forward with a number of guiding frameworks.

Changing the narrative

We can already see a more inclusive, stakeholderbased narrative emerging amongst financial brands. Barclays, for example, has unveiled special loan facilities for businesses, extended customer overdrafts, donated to charities, and showcased how their in-branch experience has moved online – in an emotive video centered around their employees.

Social media shows memories of 2008 still linger

Analysis shows that even though the public has acknowledged some of the efforts banks have made to help with the impact of the coronavirus pandemic, memories of their behaviour before 2008 and during the global financial crisis linger on.

While their decision to cancel dividends might have been welcome and, indeed inevitable, from a PR perspective, this has not been well received by investors and people depending on banks’ regular dividends for their retirement income.

On a positive note, education, help and preparation are all topics consumers are celebrating, and there is an opportunity to focus on this.

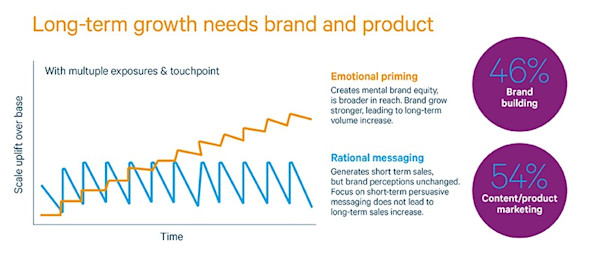

Keeping the communication drumbeat going

In a crisis, businesses typically cut costs, reduce prices and postpone new investments. In this context, marketing can be one of the first things to go. Yet businesses that continue to maintain share of voice and share of market are proven to enjoy rises in profitability that outweigh short-term savings.

■ 9x Faster recovery in stock market value from brands who advertised during the 2008-9 crisis.

■ 78% Believe brands should help them in their daily lives at the moment.

■ 8% Consumers think brands should stop advertising during the crisis.

"Winning a share of voice at this time supports a long-term recovery plan. Some 34% of our respondents said they were planning to either maintain or increase spending in 2020. There is a bank of studies from previous downturns to show that increasing investment sustains brand long-term growth… Diverting marketing expenditure into short-term price promotions usually damages brand value and is also likely to be unprofitable."

Cheuk Chiang, CEO North Asia at Dentsu Aegis Network

Make what you do more relevant

With life moving online – specifically in the way we communicate, learn, work and shop – consumers are still looking for brands to offer practical guidance, inspiration and entertainment.

Communicating during a crisis is critical for brand recognition, especially when competitors may be cutting spend. It is not a time to reduce your share of voice, but rather prioritise and increase its relevance.

Brands should be considering reviewing and changing media, messaging and touchpoints to ensure they are reaching consumers with communications they are most interested in.

Reconsider your channel mix

A new, more agile channel mix may be necessary for some brands as more people move online and operate within the confines of their homes and neighbourhoods.

■ Online video: Online video, broadcast and TV streaming take the top spots overall for increased media consumption, proving popular across all generations.

■ Audio uptake driven by millennials: Millennials are driving the increased usage of radio, podcasts and audio streaming.

■ Generational differences: Key differences include the dominance of online streaming amongst Gen Z and Millennials versus broadcast for Gen X and Boomers.

Your Quick Covid-19 Communications Checklist

Consider adapting – not abandoning – your strategy, to reflect:

1. Customer centricity: Understand how your customer is redefining value - and responding. What are their needs now? How can you meet them? What channels are most efficient in reaching them?

2. Consistency: History shows that maintaining spend can improve market share, whether competitors are cutting back or not, and customers will value the reassurance of recognising known brands.

3. Cost: Customers will be cost conscious and keen to get the best deal. The key is to remain competitive and reward loyalty.

4. Core values: Highlight what you stand for as a business to both employees and loyal customers and how these values translate into the current context.

In summary: Is now the time for financial services to shine?

As we emerge from this crisis, not only do we have a structural opportunity to be the engine of recovery, helping businesses and customers to emerge resilient, we have a greater opportunity to transform both people’s lives and our world for the better.

Communication is not only crucial, but can be transformative

At Teamspirit, we believe in transforming the world of finance for the better – something we’ve been doing for the past 25 years. Every crisis brings new challenges, but how financial firms communicate during these uncertain times is crucial for cementing and transforming their most important relationships – from employees, to customers, suppliers, creditors, investors and wider communities.

During crises, people are still hungry for information, guidance, inspiration and entertainment – and we’re currently helping our clients review their strategies and shape the stories they deliver.

Want to discuss it further?

To help you navigate the ‘new normal’, our planning team have developed a number of frameworks and insight sessions to help you re-prioritise and refresh your current strategy where necessary.

Please contact us to set up a review on how your messaging, media and communication strategy could work even harder in the context of the new needs of the Covid-19 era.

Email us at hello@teamspirit.uk.com or call us on 020 7360 7878

(All sources references in the PDF download.)