It’s only fair - How the Financial Services industry can make the recovery better.

By Teamspirit on Friday 11 September 2020

Our viewpoint, the opportunities and the potential transformation.

Nobody can be in any doubt about the material consequences of the pandemic and its impact on the UK, and indeed, the world, financially, politically and most importantly, emotionally.

While you may question our focus on the emotive side, here at Teamspirit, we believe that the relationship that people, as consumers and business owners, have with their money is undergoing a profound and long-lasting transformation. We predict this change will manifest in three ways.

Derisking

Our desire for certainty and security might drive an aspiration for rainy day savings and more balanced investment portfolios, along with a reluctance to rely on any more credit than is necessary. We have already seen evidence of this, with household savings deposits rising to a record £1.5 trillion – theoretically enough to pay off everyone’s mortgage.

Discovery

Given that we have been forced to accept change, we might come to welcome it and be more open to changing how we manage money and the brands that offer us a different experience. We’ll be more ready to consider concepts that overturn established thinking – such as the emerging idea that the equity in your home can be your retirement income, and your pension pot, your legacy.

Decluttering

As we appreciate what really matters in life, we’re likely to look at waste and extravagance with a jaundiced eye, and might pare our financial activities back to basics once again.

As our idea of ‘success’ under lockdown has become much more about quality relationships and personal wellbeing, and our idea of ‘health’ now includes personal finances and professional satisfaction, we will appreciate simplicity over complexity.

This applies in workplaces as well as families, with a greater appreciation of which expenses and investments improve quality of life (for ourselves and the community), and which are just indulgences.

The digital transformation has only just begun

Many of these changes will be enabled by technology and the acceleration of capabilities that the lockdown demanded. For example, when it comes to digital services, it’s logical that we are going to continue to embrace an online lifestyle. This will impact where we live and how we socialise, and therefore how we spend, save, invest and borrow.

Likewise, we will expect the financial brands we use to fully embrace a number of developments. From open banking to smart connected devices that harness the power of 5G communications. From the ethical use of our data and AI to develop better risk models for credit and insurance propositions, to affordability calculators for mortgages, that more accurately reflect the changing world of work.

We could see customers putting their faith in established brands to manage the long-term priorities in their financial life. In addition, they may choose to follow a new cohort, opening accounts on neoteric investment apps to engage with the cut and thrust of financial markets for themselves at low or no cost.

The new VIPs

But aside from technology, where we believe there is a more meaningful role for Financial Services to play, is in helping to broker a new societal culture – one that’s fairer, more open and more collaborative.

We would also envisage this culture being more active in its support for key workers, whose value to society has been proven throughout the pandemic; and young people, the cohort worst affected by the economic aftershocks of long-term unemployment, depressed wages and rising living costs.

Providers who make it their mission to help everyone access the UK’s world-class financial system, will make our society more inclusive, and therefore fairer, safer and more resilient.

Who will be paying?

Let’s look at how the recovery might be funded. It’s reasonable to assume that the chances of more austerity, given the political climate, are low. No Chancellor would dare to impose further cuts on vital public services, or tax increases on low earners. The Resolution Foundation has found that while the more affluent population have increased their savings, the less well off have turned to expensive credit and borrowing. Rather than exacerbate this wealth gap further, it’s more likely that the more affluent will face an expectation to step up.

Rumours are already circulating around the Treasury that the Autumn 2020 budget is likely to include a combination of personal tax and VAT cuts to benefit lower earners, alongside tax rises for the better off. There may also be further reductions in public spending, but these will come later and at a heavy political price, should the label of ‘austerity’ be applied – as it inevitably will.

Therefore, we can anticipate a number of measures to tax wealth, such as increases in Capital Gains and IHT. We might see new taxation systems created for luxury goods on top of VAT, and reductions in pension pot allowances. Pension Freedoms might not be so free in future. Investment portfolios above a certain size might incur a new range of taxation measures, and the asset management industry might find itself facing further taxation on its profits.

At the same time, the Government is likely to be taking a long hard look at the corporate structures and tax jurisdictions of multi-national companies, to ensure that profits earned through this country translate into taxes paid here. This is not a new issue, but one that is likely to have a renewed regulatory energy behind it – and the comparatively new force of social activism.

All of this could well be heralded by social campaigners and the Government, as a necessary redress against the injustices of the past and an essential step in ‘levelling up’ the country, respectively.

The avoidance of tax avoidance

The push against tax avoidance could put financial advisers in an awkward position. Where once it was considered perfectly reasonable, even best practice, to not pay any more tax than necessary, this will have to change. Given the opprobrium levelled at tax haven-dwelling disaster capitalists, paying tax according to the spirit and not the letter of the law might be a badge of honour to be worn and shared with pride.

So, while companies will be pleased to report how much tax they have paid, we are also likely to hear more granular detail from HMRC about where tax revenues come from, how they are spent, and the public services they help to provide.

Inclusive innovation

This drive for fairness and a more inclusive financial culture might also act as the impetus for a range of new product propositions, many with a health or community focus, or designed to support key workers. As part of a broader shift from ‘customers’ to ‘members’ and ‘partners’, we might see forms of community-based insurance, a resurgence of mutual societies, and new propositions in affordable housing, whereby existing homeowners invest in new properties for first-time buyers and key workers.

In fact, if we consider that vast tracts of wealth are tied up in pension funds and home equity, aside from the distinct possibility that the Government will be eyeing them covetously, we might see the development of new vehicles to release that money to help young people become more financially active and secure. This could comprise multi-generational financial products, such as an integration of equity release and first-time buyer mortgage propositions, or early access to pension pots to fund the deposit on a child or grandchild’s first home. According to research from L&G, currently 27% of all housing purchases in the UK are made with contributions from older family members.

Conversely, we might see ways for those struggling with debts to share the burden with older family members. Students, for example, could be relieved of crippling loans (which create very little income for the Government anyway) by passing them on to older family members who wish to decrease their IHT liabilities or their pension fund allowances. Of course, this could reduce revenues running back to the Government, but the counter-argument is that helping young people actively participate in the economy earlier, as homeowners or investors, could permanently boost growth.

The knowledge banks

A culture of more inclusive innovation might be applied to the relationship between banks and their SME customers. From their vantage point of serving the business community, banks and the payments industry hold a huge amount of data on the financial ecosystems of trade and commerce. This can become valuable insight into the financial attributes and behaviours that denote success (or failure).

Perhaps in future they could harness those insights to act as smart marketplaces, to help their SME customers develop new business models, benchmark their performance against category or local best practice, evaluate new strategies, identify potential partners, and share their skills and resources.

The fairness filter

If we apply the ‘fairness filter’ to fees for financial advice or investment management, we might see a shift towards more shared value/shared risk pricing models. After all, clients can argue that it’s not fair for advisers to still make a profit when they have lost money. While, of course, no adviser wants a client to make a loss, those who can offer to share some of the pain of a market fall with their client, might go on to enjoy more loyal and ultimately lucrative relationships.

These shared value/shared risk models might also be applied to business funding propositions, in which banks part-lend to and partinvest in their customers. This could be similar to the models used in affordable housing, whereby the lender retains a stake in the business that can be ‘bought out’ at a later date.

Currently, sustainability-linked loans, which are based on a pricing mechanism that reduces the cost of the loan if the borrower achieves certain ESG-related targets, are an emerging and still small sector of the business lending market overall – but the market is growing fast. According to Bloomberg data, $62 billion of sustainability-linked loans were raised worldwide in the first nine months of 2019, more than in the whole of 2018. The concept of including ESG measures as part of the banks’ overall lending criteria could be about to go mainstream – available as a standard, rather than specialist offering.

What is interesting about sustainability-linked loans, is that they are based on pragmatic, rather than ethical principles. Irresponsible practices and poor governance carry high risks, not just to reputations and brands, but to profits and dividends. Sustainability-linked loans are based not on objective moral judgements about an organisation’s behaviours, but on rational commercial decisions. In other words, the concept of investment or insurance risk is taking on a new meaning.

No time for short-term thinking

Given that the recovery may not even be starting any time soon, and it will likely take several years to return to pre-pandemic levels of confidence, we might also see a shift away from short-term thinking and towards long-term planning. Enlightened businesses, including Unilever and Nestlé, have been arguing for some years that sustainable development and the demand for immediate profits are incompatible. There is a new generation of capital investors making a compelling case for decoupling market and regulatory cycles from political ones. They are the ones investing in property and infrastructure for the next generation. But this comes with extended obligations.

As regulatory bodies across the world ban big dividends, and international trade agreements are increasingly being tagged with environmental governance clauses, investors are being challenged to think about how free their capital really is, and whether old debates over capital controls or financial transaction taxes will reappear.

As part of this, the debate over hedge fund investing, shorting currencies, and payday loans is likely to be conducted through the lens of fairness. Expect to see a move towards the fairer stakeholder capitalism, outlined in the 2020 Davos Manifesto, gain traction as the new dominant model in 2021.

ESG: from ethics to impact

But what is particularly interesting and connects the themes of technology, community, fairness and long-term thinking together, is a potential shift in the focus of ESG investing away from ethics and towards impact. The confluence of green and clean technology, sustainable development and responsible business, creates the opportunity for ESG to pioneer a new generation of innovation and help solve some of the world’s most pressing problems, from climate change and water shortages to micro-finance.

So, as we find ourselves in the Twilight zone, caught between a (hopefully) flattening curve of Covid cases and an imminent recession of unknown depth and breadth, the one thing we can say with confidence is that this is very different from the last financial crisis. In 2008, the bankers were the bad guys, vilified as ‘Masters of the Universe’ and personified in Fred the Shred.

This time, the Financial Services industry has the opportunity to be part of the solution, not the problem, helping to build a society that’s recovered and is more socially cohesive and collectively resilient.

So then… What are the marketing implications and strategy?

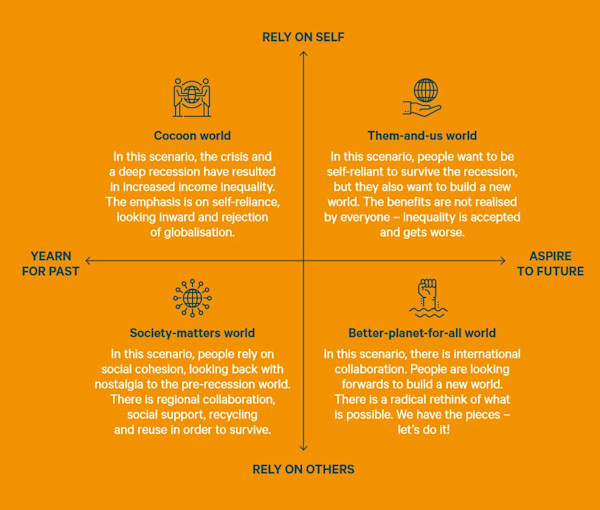

To end this piece from a marketing strategy perspective, innovation consultancy Innovia has devised, as part of a thought piece of its own, this market map of four potential scenarios resulting from the pandemic.

If we consider them, not just as scenarios or outcomes, but as audience typologies, segmented by attitudes and need states, and view them through a financial services lens, there are some clear opportunities, not just in audience insight and engagement, but in developing new products and propositions that meet their emotional as well as practical needs.

Cocoon world

The audience defined in the ‘Cocoon’ world segment, for example, are looking for products that give them the personal safety and security they remember from the ‘good old days’; days in which they had what they perceive to be a more direct and personal relationship with banks, building societies, insurance companies and pension companies – and are more trusting towards UK providers, especially those with heritage, history and a more conservative positioning. Their preference for self-reliance might lead to a greater propensity to use their own assets, such as equity release or making withdrawals from their pension savings, rather than trying to grow their assets through investment and speculation. Digitally remastered ‘retro’ products such as virtual piggy banks and savings books might resonate with this audience. This strong sense of self may also mean that they respond well to messaging that praises their responsibility and commitment, and recognises the value of small, everyday pleasures over unrealistic lifestyle depictions.

Them-and-us world

The ‘Them-and-us’ audience, by contrast, while equally selfreliant, are more motivated by change and look forward, not back, to find the financial providers and products they need. At the same time, they will have a greater propensity to compare their situation with those of others, particularly providers that they believe to be unethical or unfair, disaster capitalists who have acquired their wealth at the expense of others, or companies that perform badly on the ‘Governance’ dimension of ESG investment. They are likely to have strong feelings about their family finances, with a greater propensity to intergenerational wealth planning, and more openness towards new product development in multigenerational products such as mortgages and investments. They are likely to respond well to messaging that emphasises fairness, that recognises their power and control as a financial consumer, and that gives them a role to play in helping to create a new and better world.

Society-matters world

The ‘Society-matters’ world audience, although less insular and more collaborative, look to the past and a golden era of community-based financial products, such as mutual societies and savings clubs and more local banks and building societies, when providers were perceived as fulfilling a societal duty. They are likely to be more positive towards more recent communal products, such as peer-to-peer lending and investment, and emerging models such as social insurance.

At the same time, they are more likely to be motivated by the ‘Social’ element of ESG investment, feeling more positive towards investment opportunities that have a community focus, such as social enterprises, or companies in the health and education sectors. In future, their need for financial advice might be fulfilled by financial planning ‘clubs’ whereby members share the cost (and the benefit) of an adviser. They are likely to respond best to messaging that demonstrates understanding of their local area and regional concerns, that echoes traditional social values of collaboration and neighbourliness, and gives them a voice in the customer community.

Better-planet-for-all world

The ‘Better-planet-for-all’ audience see themselves as global citizens, keen to play their part in building a world that works for everyone. They are more likely to be interested in the global economy and in innovative financial products available in other parts of the world, creating the potential for a more international marketplace.

They are also more likely to consider ESG from an environmental and social perspective, and its capacity to fund the innovations with the potential to solve the world’s biggest problems, from agriculture and health to climate change and green energy. They might also be keen to play an even more active role in their investments, with opportunities to provide more direct support and the benefit of their experience to the organisations they are helping to fund.

Also, they might be willing to consider ‘donating’ their financial adviser’s time to help others, supporting financial advice charities alongside their advice fees, or joining in crowd-sourced problem-solving initiatives enabled by providers sharing their data and insights. They are the most likely to be motivated by inspiring visions of the future, to feel that they have the power to effect change and to have a material role in effecting that change through the financial choices they make.

Five areas for brands to start addressing in recovery

1. Reputation, more than ever

In the current climate, people want to see businesses act with integrity and transparency and deliver on their promises. Connection with your brand is vital to maintaining and recovering market share in the wake of any crisis. Nowhere has this been more evident recently than in the supermarket sector. The major supermarkets have used multi-channel communication strategies to move from simple food provider to an essential public service. And Opinium’s April research found that these were the brands people felt had responded most positively to the pandemic. Businesses cannot just pay lip service to reputation: it has to have meaning, and depth. Effective communication must work hand in hand with the operational strategy of any well-run business.

This is about much more than what you do or say as a business; it’s about the essence of why your business exists and how it’s holding itself accountable.

2. UX - Revisit & Investigate

In a business world that has finally had its hand forced and become fully digitally focused, the online experience now has to be the focus of investment for businesses that will now live or die through their customers’ full experience. Starting with revisiting their customer personas and purchasing styles, it is essential that businesses focus on the online journey, and how that dovetails with the rest of the customer experience, whether in store or on the phone. Then making sure it’s personalised for each individual. We envisage that there will be a lot of work focused on micro UX in the coming months. That means the key point of interaction, be that ensuring customers see the easiest way to the next stage of their journey, or how easy it is to stay in touch.

__Small percentages of uplift in customer engagement are going to be crucial to future success. It’s time to start to focus small, not just big.

3. Authentic social really counts

More than ever in the last few months, it has become impossible for businesses that want to win in the social space, to not consider more of a customer-centric approach to their social marketing. With the rise of influencers and peer-to-peer reviews being considered the most ‘authentic’ content when it comes to lead generation and brand awareness, it’s important that businesses step into this space to not get left behind.

Active C-suite social profiles, as well as value-added content exchanges, are key drivers in terms of reaching and engaging your audiences in an authentic way for long-term loyalty.

4. Purpose and culture: the new ‘4 Rs’

From John Lewis revisiting its ‘Never Knowingly Undersold’ customer promise after 95 years, to brands focused on one-to-one sales or in-store experience, the need to Revisit, Refine, Redesign and Reinvigorate mission, vision and values is increasingly being discussed with us by clients as each month goes by. In relation to both their external audiences and internal culture. The output being not just validating and exercising due marketing diligence on their current purpose, but also aligning it with the short, medium and long-term commercial opportunities that Covid has accelerated for forward-thinking FS and FinTech brands.

Revisit, Refine, Redesign and Reinvigorate.

5. Think internal experience not internal comms

With Schroders and PwC already announcing a significant (or total) departure from the traditional office, companies are reviewing the necessary new needs of the internal employee experience (what we term IX). The need for a rethink on how town halls, key business announcements and social engagement can be replaced and updated to reflect the new needs of motivation, engagement and information.

What is the IX for your more important audience?

Want to discuss these ideas further?

To help you, our planning, analysis and social teams have developed a number of frameworks and insight sessions to help you reprioritise and refresh your current strategy where necessary.

Please contact us to set up a review on how your messaging, media and communication strategy could work even harder in the context of the new needs of recovery.

We’re always ready to help.

hello@teamspirit.uk.com

Visit Teamspirit.uk.com or call us on 020 7360 7878