The Great Pension Disruption

Pensions have historically been somewhat unloved. But in recent years, moves have been made to help educate, encourage, and engage those saving for their later years. Is it time for more drastic disruption though? Teamspirit has been keen to find out.

Disruption

Communication

Pensions are complex. Which means communicating information about them can be equally as difficult. Especially when it comes to education and engagement. With that in mind, we asked four of our in-house experts for their views, and how their area of expertise could be used to improve how we navigate pensions.

READ THE ARTICLE

READ THE ARTICLE

READ THE ARTICLE

READ THE ARTICLE

Frustration

In 2020, 67% of UK adults had not logged into their pension, and for those over 55 that figure rose to 78%!* But why are people turning a blind eye to their own cash and their own future? This must be giving providers, financial advisers, and wise friends everywhere quite the headache.

So we went straight to the source and asked people when they last looked at their pension and what might be stopping them engaging further.

What’s stopping us engaging?

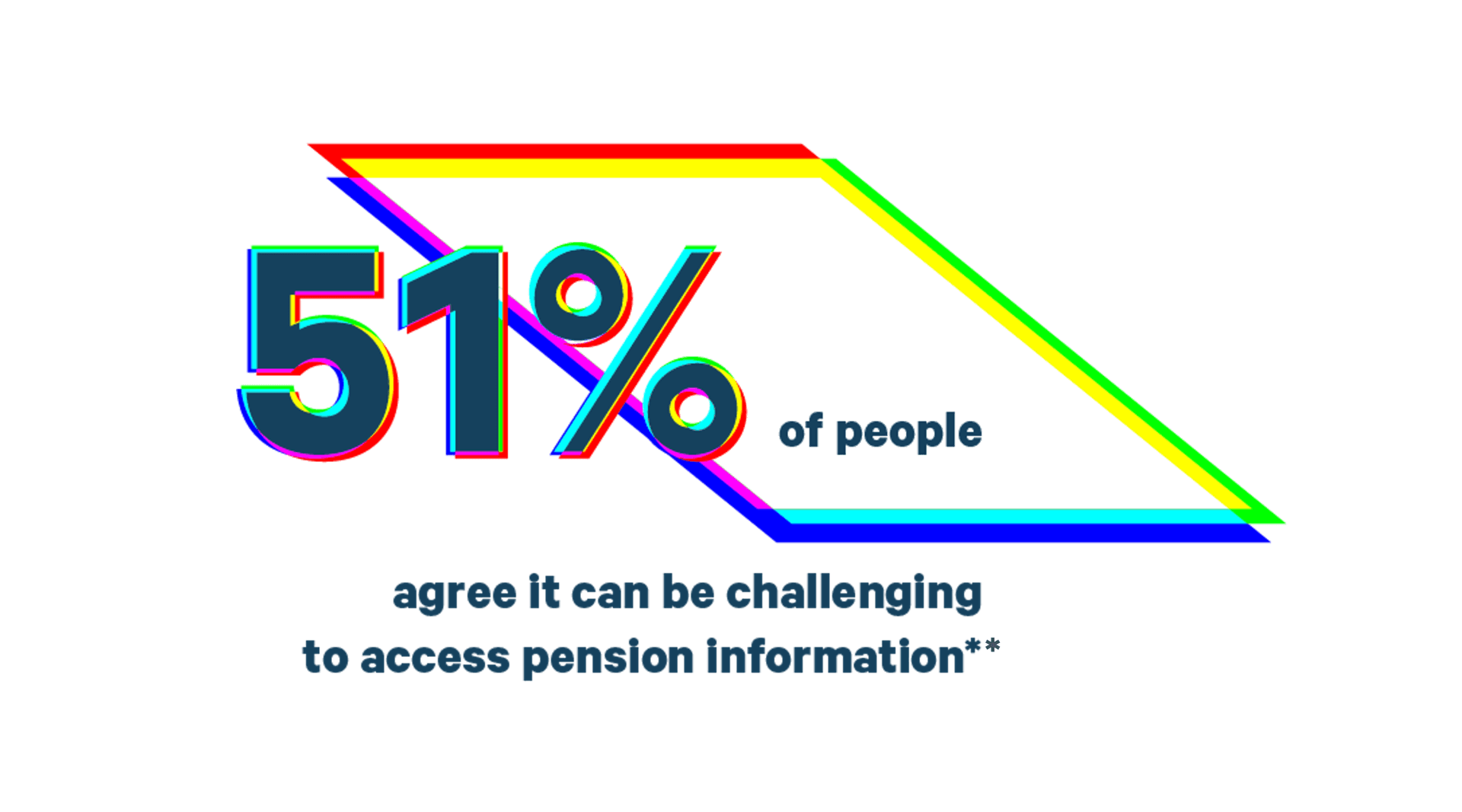

Being a specialist financial agency, we love storytelling and stats equally. So following our real-life video research, we then unearthed some interesting insights and looked further into barriers that have put paid to pension progress.

If you’d like to speak to us about how to make pension communications more engaging, email the team at hello@teamspirit.co.uk

And for some unexpected and exciting inspiration, take a look at the #PensionAttention campaign, which went live in September 2022.

* Canada Life: https://www.canadalife.co.uk/news/pension-engagement-challenge-remains-despite-significant-increase-in-financial-awareness

** The Association of British Insurers: https://www.abi.org.uk/globalassets/files/publications/public/lts/2022/britain-things-pensions-dashboard-report-jan-2022.pdf